Bank Reconciliation Statement: Examples and Formula

Bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. In the case of personal bank accounts, like checking accounts, this is the process of comparing your monthly bank statement against your personal records to make sure they match. Many banks allow you to opt for fee-free electronic bank statements delivered to your email, but your bank may mail paper bank statements for a fee. A bank reconciliation is a critical tool for managing your cash balance.

Accounting for Cash at the Company

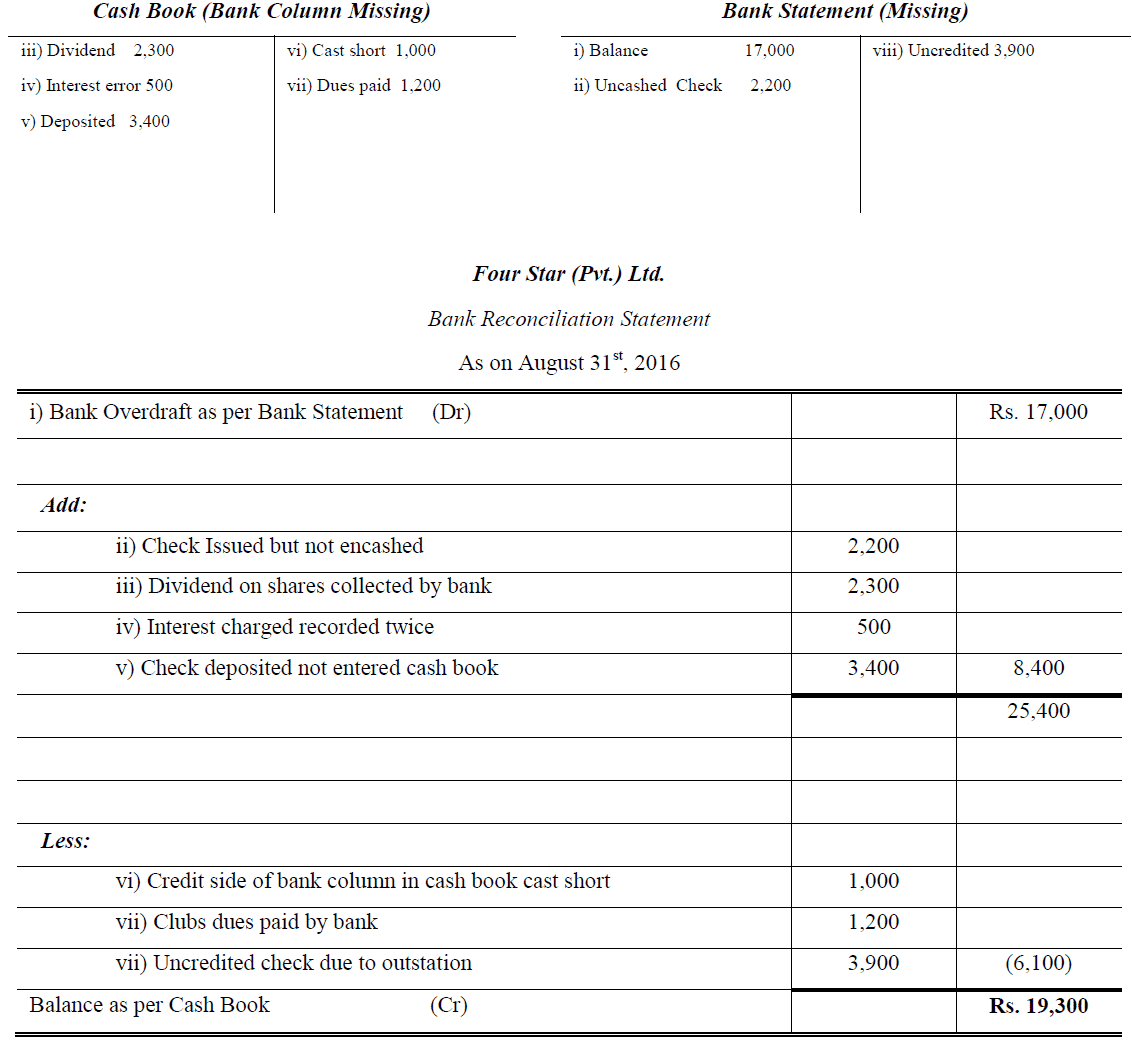

Once you’ve identified all the items that align between the two records, it’s time to account for any discrepancies. These may include deposits in transit, outstanding checks, bank fees, or miscalculations by the bank or the internal accounting team. Accurate cash flow is essential for keeping a business running smoothly, so it’s important to be aware of all incoming and outgoing cash. A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow. How you choose to perform a bank reconciliation depends on how you track your money. Some people rely on accounting software or mobile apps to track financial transactions and reconcile banking activity.

Bank Statement – Timing Differences

In these situations, it’s a good idea to perform an immediate reconciliation. There are bank-only transactions that your company’s accounting records most likely don’t account for. These transactions include interest income, bank deposits, and bank fees. Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet.

How To Do A Bank Reconciliation: Step By Step

- Generally speaking, bank reconciliations should be completed on a monthly basis to ensure accuracy and timely updates.

- All of this can be done by using online accounting software like QuickBooks, but if you are not using accounting software, you can use Excel to record these items.

- If a company is unaware of the exact amount of these fees, they may not be included in the company’s financial records and will only be seen when they receive their bank statement.

- In this instance, your bank has recorded the receipts in your business account at the bank, while you haven’t recorded this transaction in your cash book.

(f) The cash book does not contain a record of bank charges, $70, raised on 31 May. The items therein should be compared to the new bank statement to check if these have since been cleared. They also explain any delay in the collection of cheques, and they identify valid transactions recorded by one party but not the other. When completed, the reconciliation should show the correct cash balance.

Due to the overwhelming paperwork that the financial department deals with, it’s possible that some invoices get misplaced or are never recorded. Also, if you’ve made a check payment at the end of the month, it might not clear until the following reporting period. With that information, you can now adjust both the balance from your bank and the balance from your books so that each reflects how much money you actually have. Bank reconciliations may be tedious, but the financial hygiene will pay off. Our team is ready to learn about your business and guide you to the right solution. Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services.

Infrequent reconciliations make it difficult to address problems with fraud or errors when they first arise, as the needed information may not be readily available. Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. A bank reconciliation statement can help you identify differences between your company’s bank and book balances. You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business, as well as any expenses paid by the business. This includes everything from wages and salaries paid to employees to business purchases like equipment and materials.

For interest-bearing accounts, a bank adjustment could be the amount of interest you earned over the statement period. Reconciling your bank statement used to involve using a checkbook ledger or a pen and paper, but modern technology—apps and accounting software—has provided easier and faster ways to get the job done. Regardless of how you do it, reconciling your bank account can be a priceless tool in your personal finance arsenal. As a result, you’ll need to deduct the amount of these checks from the balance. Such information is not available to your business immediately, so you record no entry in the business’ cash book for the above items.

If you’re not careful, your business checking account could be subject to overdraft fees. In order to prepare a bank reconciliation statement, you’ll need to obtain both the current and the previous month’s bank statements as well as the cash book. The purpose of reconciling bank statements with your business’ cash book is to ensure that the balance as per the passbook matches the balance as per the cash book. Nowadays, all deposits and withdrawals undertaken by a customer are recorded by both the bank and the customer.

The bank statement of the Fast Company shows a balance of $10,000 on January 31, 2021 whereas the company’s ledger shows a balance of $8,525. It is important to note that it takes a few days for the bank to clear the cheques. This is especially common in cases where the cheque is deposited at a different bank branch than the one at which your account is maintained, which can lead to the difference between the balances.

Bank errors are mistakes made by the bank while creating the bank statement. Common errors include entering an incorrect amount or omitting an amount from the bank quote definition statement. These miscalculations can also occur on the business’s financial records. Compare your personal transaction records to your most recent bank statement.